Technology that can quickly combine and analyse billions of disparate pieces of data into a “single source of truth” is helping authorities fight back against sophisticated criminals and simultaneously improving the speed and efficiency of government decision-making.

Known as Decision Intelligence, its ability to draw together enormous tracts of internal and external data into a single trusted source has been used by the British Cabinet office and the Australian Government to trace sophisticated networks and crack down on fraud in government programs.

Imam Hoque, a co-founder of London-based Quantexa, said demand for the company’s Decision Intelligence Platform and related solutions for government, banking, insurance, and, Technology, Media, and Telecommunications, was growing as organisations were increasingly in need of a reliable unified data source.

“Traditional approaches and technologies are not solving this need,’’ he said.

Quantexa’s Decision Intelligence Platform helped the British Cabinet Office identify more than 50 organised groups which had defrauded more than $15 million (£8 million) from the British Government’s COVID-19 loans scheme.

In Australia, Decision Intelligence has been used by one Government Department since 2021 to detect fraud and improve efficiency.

It saved the department more than $1 million in its initial implementation phase as it drove more targeted investigations and greater efficiencies in decision making.

Three of the four big banks in Australia have adopted Quantexa’s Decision Intelligence Platform and financial services, and gaming companies are using the platform to provide deeper insights into their data and risks.

Seeing the ‘big picture’ to drive performance

Mr Hoque said Decision Intelligence was all about having “the data at your fingertips’’.

One of the biggest obstacles for public sector agencies in making decisions was fragmented and siloed data which prevented leaders from seeing the full picture.

While this was a major challenge, it was also a significant opportunity to improve efficiency and performance.

Decision Intelligence could enable agency leaders to access the “big picture’’ when they were making difficult decisions at strategic, operational and tactical levels.

The addition of machine learning and artificial intelligence also provided an opportunity to automate and augment repetitive decision-making, freeing up public servants’ time to perform higher-value tasks. Crucially, Quantexa’s composite AI approach ensures any decisions or suggestions are explainable, transparent and without bias.

Around the world the adoption of Decision Intelligence has been producing remarkable results.

One government’s tax department has collected an additional $1bn a year because officials could find problems relating to tax fraud earlier before refunds have been distributed.

A Customs Department used the platform to assess import declarations in real time by linking historical data to produce alerts about risky shipments that might be connected to dangerous components, contraband, forced labour or items that were not allowed into the country.

Mr Hoque said by loading the appropriate data into a data lake, it was possible to rapidly create any number of models for different scenarios to both execute ‘what-if analysis’ as well as react to unfolding events.

“We help our clients bring unstructured and structured data together, extract meaning and help organisations to make better decisions,’’ Mr Hoque said.

Many of Quantexa’s customers had large data sets requiring sophisticated data management.

“The bigger the better,’’ Mr Hoque said.

“We are often brought in to solve for a single business challenge that we can solve with the dataset,’’ he said. “However, we are often able to solve many others once the single trusted data source is created.

“Using the large dataset, our platform applies Entity Resolution which allows the organisation to build a data foundation that becomes a centralised resource for all decision makers.’’

He said Quantexa utilised open architecture technologies, allowing solutions to be scaled up using cloud environments.

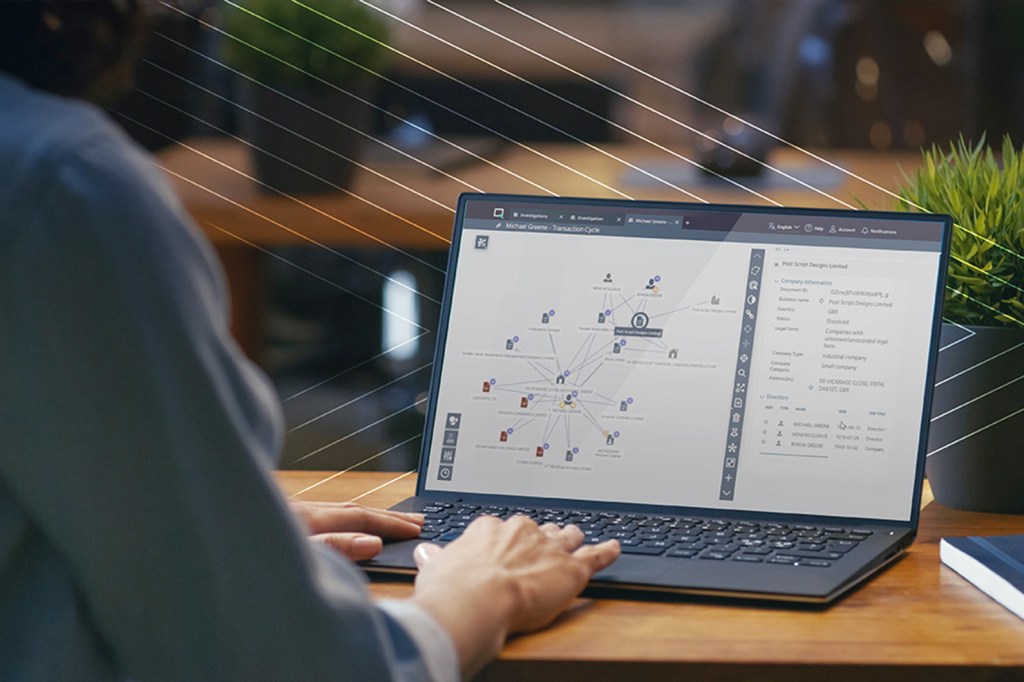

AI and graph analytics were deployed to uncover networks and to find hidden connections to identify risks and opportunities.

Helping the British Cabinet Office tackle fraud

Quantexa was called in by the British Cabinet Office to detect fraud in the Bounce Back Loan Scheme (BBLS) designed to help small and medium businesses during the COVID-19 pandemic.

Banks and other commercial lenders administered more than $90 billion (£47 billion) of government-guaranteed, low-interest loans through the BBLS to more than 1.5M companies. But the British Department for Business, Energy and Industrial Strategy estimates put the proportion of potentially fraudulent loans at 7.5%.

A collaboration between Quantexa and the Cabinet Office deployed the Decision Intelligence platform in just three months, feeding in more than 100 million data items.

One of the most important data sets was from Companies House, which enabled networks to be unearthed enabling authorities to understand how individuals and entities were connected.

This provided a means for UK Government investigators to see not only individual perpetrators of fraud but their complete network of connections to other enterprises and individuals.

Fifty networks were identified, and this information was shared with lenders.

Subsequent collaboration sessions between the government and lenders identified more than $15 million (£8 million) in loans that were confirmed as fraud. The work also reduced the number of false positives generated by fraud detection by 20%.

“From our perspective, the return on investment is healthy,’’ Craig Martin, Fraud Analytics Lead & Head of Program at the Cabinet Office said. “We’re looking at about 10-to-1 ROI for every pound we spend on the technology.’’

“With the network analytics and entity resolution capabilities that Quantexa a provides, we’re not only seeing evidence of opportunistic fraud, but also organised fraud,’’ Mr Martin said.

Mr Hoque said Australia, like other technologically advanced countries including the UK, parts of Europe and the United States, was leading the way in its adoption of data, AI, and Decision Intelligence.

However, projects across the globe, such as the work with the British Cabinet Office on the Covid-19 loans scheme, had pushed the boundaries of technology adoption in government further than most.

Being data-driven now essential

Mr Hoque said being data driven was no longer an aspiration for government agencies, but a necessity.

“The most common challenges addressed by customers using Quantexa’s Decision Intelligence Platform include data management, knowing their customers, fraud, financial crime, and customer intelligence.

“Our platform helps organisations unify their data and transform decision making,’’ he said.

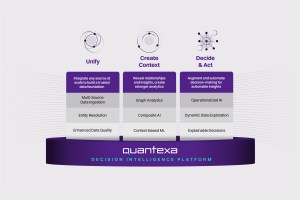

“It is about being able to activate your data, reveal relationships and insights, and create stronger models. You can then augment and automate decision making for actionable insights.’’

Mr Hoque said Decision Intelligence could help the Australian government address fraud and non-compliance risks to government benefits like welfare, Medicare, and the health and aged care systems.

It could increase Australian Public Service efficiency and reduce risks in grant, stimulus, and emergency support programs.

It could also support cross-government taskforces focused on intelligence, law enforcement, fraud, and organised crime.

It could help make the Australian tax system less susceptible to organised fraud, provide agencies with a trusted and wholistic view of their customers, suppliers, providers, and employees.

It could address supply chain risks and support due diligence checking to ensure vulnerable Australians were protected from unscrupulous operators and organised crime.

Decision Intelligence can be combined with AI to parse, match, link, and process global company data to produce models that can suggest a company is a shell, shelf, or phoenix company.

“Our approach is to use composite AI which blends techniques such as deep learning, machine learning, statistical analysis and expert input to build models,’’ Mr Hoque said.

With the re-emergence of the El Nino weather pattern increasing the risk drought and a damaging fire season this summer in Australia, Mr Hoque said Decision Intelligence could help in any disaster response.

“It can empower agencies in responding to and investigating fraudulent claims to disaster relief in real time,’’ he said.

“This supports with improving operational efficiency and ensuring faster payment to genuine claimants.

“Our platform can be integrated into existing systems to boost efforts to ensure payments are only going to those who legitimately need assistance and benefit from the program,’’ Mr Hoque said.

“This ultimately leads to a more productive APS workforce, faster provision of emergency support, and a reduction in lost taxpayer funds through fraud.’’